The Sustainability Paradox: Why Good Brands Are Failing

- Dec 21, 2025

- 5 min read

The Reality Check

The world of business is currently facing a confusing contradiction. On one side, everyone seems to want sustainability: climate anxiety is at an all-time high, governments are passing green laws, and consumers say they want responsible products. Yet, when you look at the actual market, sustainable brands are collapsing at an alarming rate.

The years 2023 and 2024 have been a brutal "correction event." We have watched the failure or retreat of high-profile companies ranging from material innovators like Renewcell to food disruptors like Meatless Farm and Tattooed Chef. This isn't just bad luck; it’s a systemic issue. The global economy is built for speed and cheapness, while sustainability requires patience and higher costs. This report breaks down exactly why "doing the right thing" is currently a dangerous business strategy, backed by the hard numbers (stats) that explain the crisis.

The Money Problem: The "Green Premium" vs. Reality

The biggest hurdle is simple math. Sustainable products cost more to make because they pay fair wages, use better materials, and avoid polluting. Conventional products are cheaper because they don't do these things. This difference in cost is called the "Green Premium."

The Math Doesn't Add Up: The Sustainability Paradox

To survive, a business needs to sell its product for more than it costs to make. But sustainable brands are stuck in a trap:

The Cost Reality: Making a truly sustainable product—like organic cotton clothing or plant-based meat—often costs 75% to 85% more than making the conventional version. In fashion, markups can hit 150% to 210% due to the high price of ethical labor and lower crop yields.

The Consumer Limit: While people say they care, their wallets tell a different story. In 2024, consumers indicated they were willing to pay an average premium of only 9.7% for sustainable goods.

This creates an impossible gap. Brands need to charge nearly double to survive, but customers are only willing to pay about 10% extra.

The Inflation Factor

When inflation spiked in 2023 and 2024, this gap widened. About 62% of consumers cited inflation as the biggest risk to their shopping habits, leading them to trade down to cheaper, generic options. Sustainability is often viewed as a luxury; when rent and grocery prices go up, saving the planet gets cut from the household budget. This was a key driver in the collapse of the plant-based meat market, where products often cost more than animal meat because they lack the government subsidies that traditional agriculture enjoys.

The Human Factor: What We Say vs. What We Do

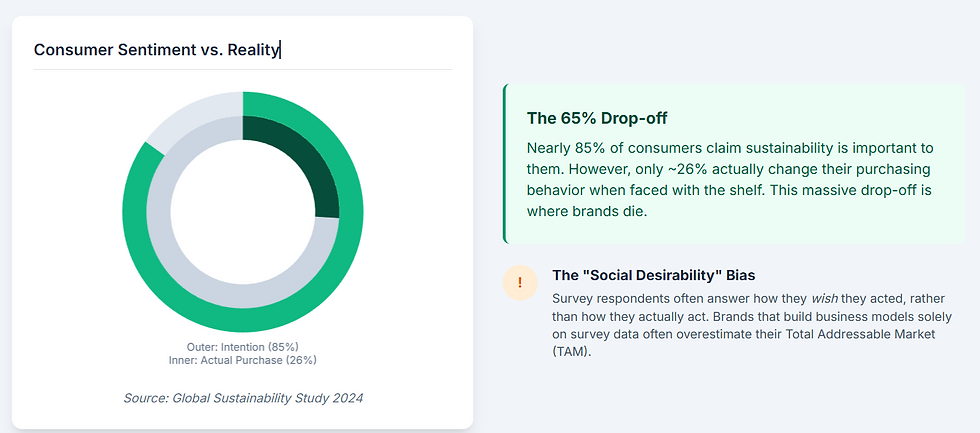

A major reason these brands fail is that they trust what consumers say in surveys. This is known as the "Attitude-Behavior Gap." We aspire to be green, but we shop for convenience and price.

The "Phantom Demand"

The stats paint a clear picture of this disconnect:

The Aspiration: Approximately 78% of consumers agree that sustainability is important.

The Action: Only about 26% actually follow through with their wallets.

The "Green Gap": This means roughly half the market is "phantom demand"—people who say they will buy, but disappear at the checkout counter.

The Performance Trap

Consumers generally won't sacrifice quality for ethics. If a sustainable product works worse than the regular version, it fails. This is the "Green Penalty."

Functional Failures: History is full of eco-flops, like the B&Q/Valspar ammonia-free paint that customers complained smelled like "cat pee," or paper straws that dissolve in your drink.

Aesthetics Matter: In fashion, brands often fail because they ignore style. Nike’s "Considered" line didn't work because it tried to sell environmentalism to sneakerheads who cared about street style and performance first.

The Addiction to "Newness"

We are culturally addicted to cheap, fast consumption. Sustainable fashion brands like Mara Hoffman designed durable "forever pieces" meant to last years. The irony? By making high-quality clothes that didn't need replacing, they capped their own sales. Meanwhile, fast fashion giants like Shein release thousands of new items daily, catering to our desire for a "dopamine hit" of cheap novelty—a habit that inflation has only reinforced as people look for small, affordable treats.

The Supply Chain: A Bridge to Nowhere

Even when brands have customers, they often fail because the infrastructure to support them simply doesn't exist. They are trying to run a new operating system on old hardware.

The "Missing Middle": The Renewcell Tragedy

Renewcell was a Swedish company that figured out how to recycle old jeans into new fabric. It was a breakthrough, yet they went bankrupt in 2024. Why?

The Stand-Off: Big brands (like H&M) signed letters promising to use the material eventually. But the factories that spin yarn (the middle of the supply chain) wouldn't buy the expensive pulp without guaranteed orders. Renewcell died waiting for the brands to put their money where their mouth was.

The Nightmare of Returns (Reverse Logistics)

For brands trying to be "circular" (taking back used clothes to resell or recycle), the logistics are a financial black hole.

The Cost of Returns: Handling a return can cost 66% of the item's original price due to shipping, cleaning, and repackaging.

High Return Rates: Online return rates for fashion hover between 30% and 40%.

The Reality: Because it is so expensive to process these returns, many "take-back" programs are just marketing stunts. It is often cheaper for companies to landfill returned clothes than to clean and resell them.

The Funding Freeze: From "Climate Tech" to AI

Startups live and die by Venture Capital (VC). In 2020-2021, money for green projects was cheap and plentiful. In 2024, that tap turned off.

The Great Capital Shift

Investors have short attention spans.

The Drop: In 2024, VC investment in climate tech dropped by approximately 14%, totaling around $30 billion.

The AI Magnet: Where did the money go? Artificial Intelligence. AI startups saw a massive surge, with AI-related funding jumping to nearly 32% of the total pot. Investors prefer AI because it scales essentially for free (software), whereas sustainable materials require building expensive factories (hardware). This left hardware-heavy companies like Bolt Threads (mushroom leather) in a "Valley of Death"—unable to raise the millions needed to build factories.

The Wholesale Collapse

Small independent brands like The Vampire's Wife relied on selling their clothes to luxury department stores (wholesale). When retailers like MatchesFashion collapsed in 2024, they took the small brands down with them.

Unpaid Bills: Brands were left with unpaid invoices totaling millions. The Vampire's Wife alone was owed over £30,000 by MatchesFashion.

Payment Terms: Big retailers often take 90 days to pay small brands, effectively treating them like a bank. Small sustainable brands don't have the cash reserves to survive that wait.

Trust Issues: Greenwashing and Silence

Marketing sustainability has become a minefield.

Broken Trust

Consumers don't know who to believe anymore.

Misleading Claims: A study found that 60% of sustainability claims by major fashion brands were misleading. For H&M specifically, 96% of their claims were found to not hold up under scrutiny.

The Result: Because fast fashion giants successfully pretend to be green, genuine sustainable brands struggle to stand out.

"Greenhushing"

Terrified of being sued for "greenwashing" or attacked by anti-ESG politicians, many companies have started "Greenhushing"—staying quiet about their sustainability work.

The Problem: If a brand doesn't explain why it costs more (e.g., "we pay living wages"), the consumer just sees a high price tag. Without the story, the value proposition vanishes.

The wave of failures in 2023-2024 isn't because sustainability is a bad idea—it's because the current business models are incompatible with economic reality. The "Green Premium" is a wall that most consumers cannot climb in an inflationary economy.

For sustainable brands to survive, they need to stop relying on the "conscience" of the consumer and start competing on price and performance. They cannot just be "the green option"; they have to be the better option that happens to be green.

.png)

Comments